Who is Liquiloans?

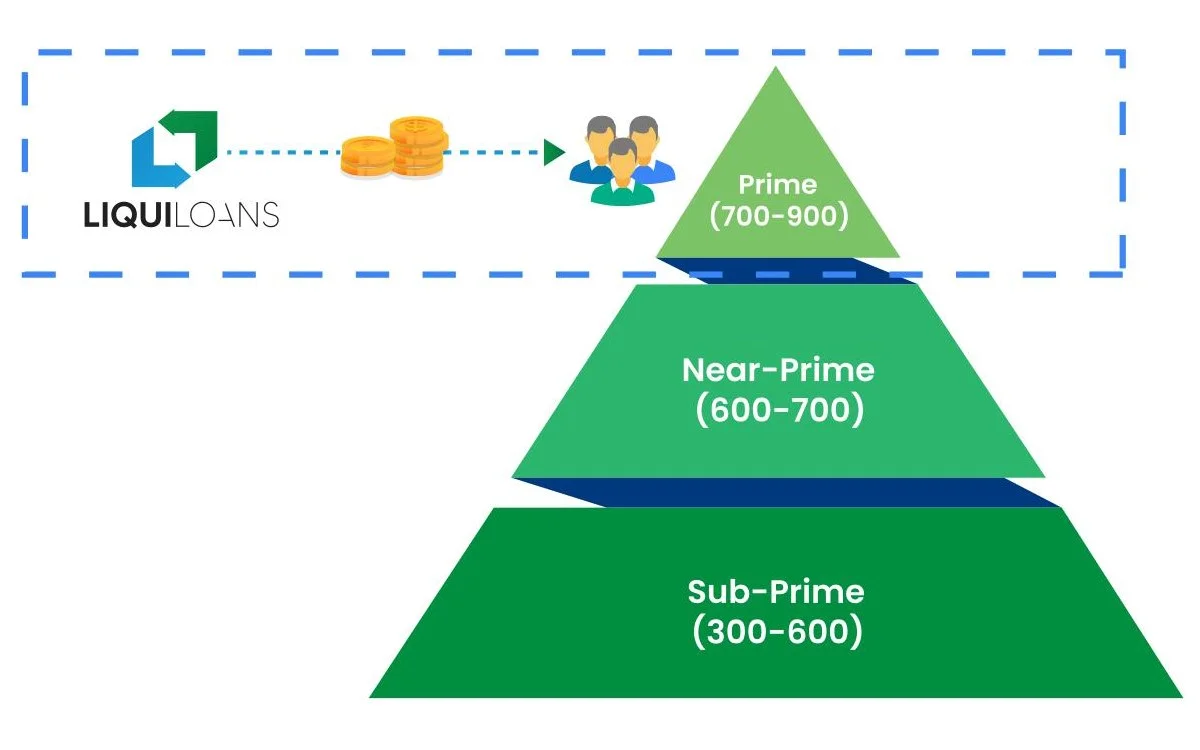

LiquiLoans (LL) is a Profitable RBI Regulated Peer-to-Peer (P2P) NBFC founded in 2018. LiquiLoans is the only P2P platforms in India which provides lenders an access to India’s Prime Retail Borrowers i.e., Safest Borrowers.

LiquiLoans is founded by Mr. Gautam Adukia and Mr. Achal Mittal who have previously co-founded a successful rental platform Rentomojo and have 25+ years of LiquiLoans is funded by Matrix Partners, who are investors in OlaCabs, Practo, Quikr and Cloud Nine. Other Marquee investor is CRED (Founded by Mr. Kunal Shah)

What Does Liquiloans Offer?

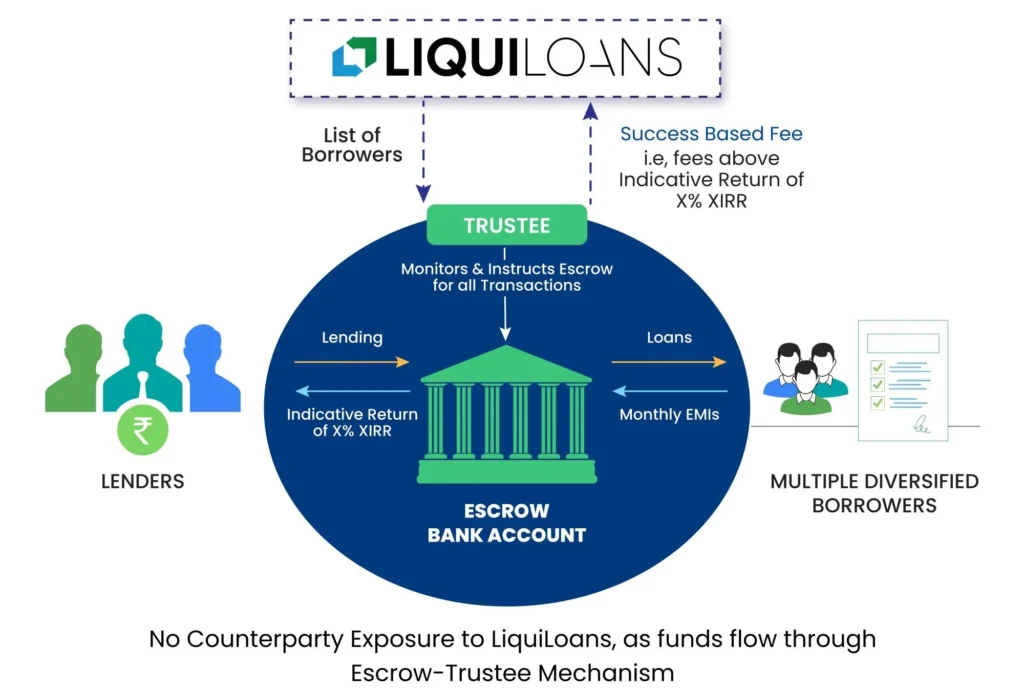

LiquiLoans’ enables lenders to safely earn indicative 10.5% returns by assisting them to create a super safe retail debt lending portfolio (lend funds in a diversified manner to prime retail borrowers having an Avg. Credit Score of 700+ (Top 15% of India’s Retail borrowers)). Owing to LiquiLoans’ Lender First Policy, the lenders shall indicatively earn their capital and yields before any fee is paid to LiquiLoans. Also, the flow of money: Lending to receiving back the Capital & Returns happens through a 3″ party escrow bank account managed by a 3″ party trustee.

How Does The Liquiloans Platform Work?

Lending via the platform is a simple 1-minute process. Detailed steps are given below:

Lender Registration (KYC + Agreement)

Register by providing Valid KYC documents & signing the Onboarding Agreement

(E-sign / Physical Mode)

Selection of Lending Scheme from NIL MHP to 36 Months MHP (Lock-In’s)

Select Tenure Based Schemes (NIL/3/6/12/24/36 Month Minimum Holding Period Schemes) offering indicative 8% to 10.5% annual returns. Start lending with just Rs. 10,000

Fund Transfer to Escrow Account (Secured Fund-Flow Structure)

Funds flow directly to a 3" Party Escrow Bank A/c managed by a Bank Sponsored Trustee ensuring the lender's funds don't flow to LiquiLoans' Bank account.

Loan Disbursal Only to Prime Retail Borrowers (Avg. 700+ CIBIL Score)

Funds can be lent out to an Avg. 200+ Creditworthy Borrowers (India’s Top 15% Retail Borrowers) who primarily avail the No Cost EMI Loans via LiquiLoans' Vendor Partners in Education, Healthcare & Home Decor Segments etc.

EMI Collection in Escrow (No Counterparty Risk)

EMis from borrowers are collected in the Escrow Bank a/c (Via Auto-Debit i.e. NACH Mandate), ensuring loan recovery is automated & frictionless

Lender Earns Return First (100% Alignment)

Depending on the Lending scheme opted, each lender can earn their returns / interest first ie. no fees/expense ratios are charged

LiquiLoans Fee Solely Success Based

Only after the Lender earns back their capital and return, Liquiloans becomes eligible to earn their success based fee. Hence there is very strong incentive to collect / recover all EMls from each borrower

What Is The Role of Liquiloans?

LiquiLoans as a platform plays a critical role of assisting each lender to safely lend funds to only creditworthy retail borrowers who pass the stringent credit assessment, thereby enabling lenders to earn a high return by taking minimum/nil risk.

A. Who are creditworthy retail borrowers?

In India, all retail borrower’s get a credit score from CIBIL/Experian/CRIF (Top Credit Rating Agencies for Individuals) ranging between 300-900.

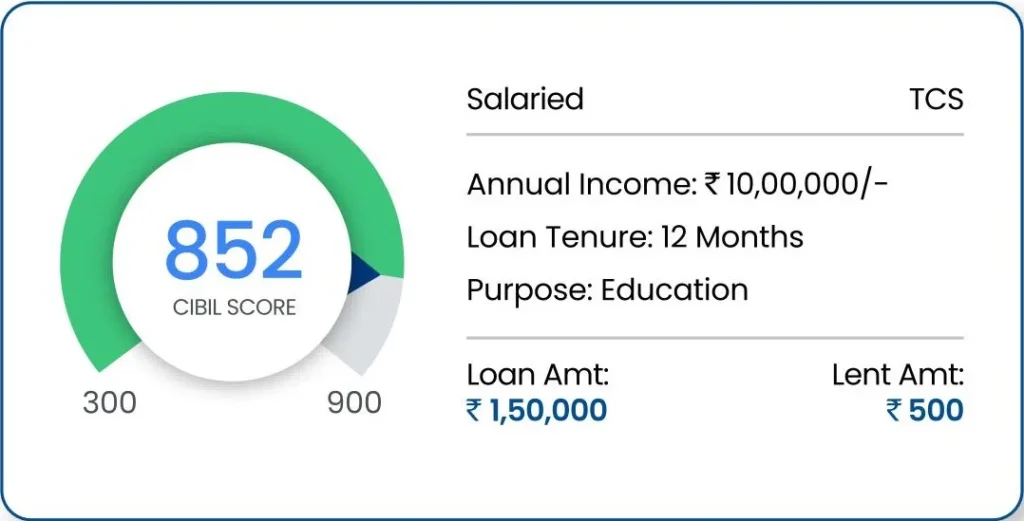

This is based on their past repayment performance which showcases their ability and intent to repay multiple credit lines/loans. The borrowers having a higher score (Avg. 700+) are considered to be the safer amongst the lot. LiquiLloans sources such Prime Borrowers.

B. How are high quality borrowers sourced?

To Source High Quality Prime Retail Borrowers LiquiLoans has tied up with:

1. India’s Largest Service Providers: 550+ Partners

2. Services Offered:

- Up-skilling Education (Online MBA, Coding, Quant Trading, Data Science Courses Etc.)

- Discretionary Non-Fatal Healthcare (Hair & Skin Care, IVF & Stem Cell Procedures) &

- Home Décor (Upgradation of Self Owned Residential Property E.g: Modular Kitchen etc.)

3. Loans Offered: Primarily No Cost EMI Loans

- Avg. Loan Value: Rs. 50,000 (Max. Upto Rs. 10 Lakhs)

- Avg. Loan Tenure: 10 -12 Months+ (Max. Upto 36 Months)

4. Revenue Model:

- Earnings via upfront discount (subvention) offered by service providers for all approved customers

C. How are borrowers evaluated?

Liquiloans sources only Prime Retail Borrowers who largely opt for a No Cost EMI Consumer loan solely as a payment flexibility.

100+ data points are checked before approving the loan.

Prime Borrower Evaluation Criteria — 3 Step Process:

D. How does Recovery happen in case of a default?

All borrowers sourced by LiquiLoans mandatorily sign an auto-debit mandate making it easy to collect EMIs on time.

To ensure minimal delays/defaults, Liquiloans has multiple internal and external safeguards.

Why is Liquiloans Safe?

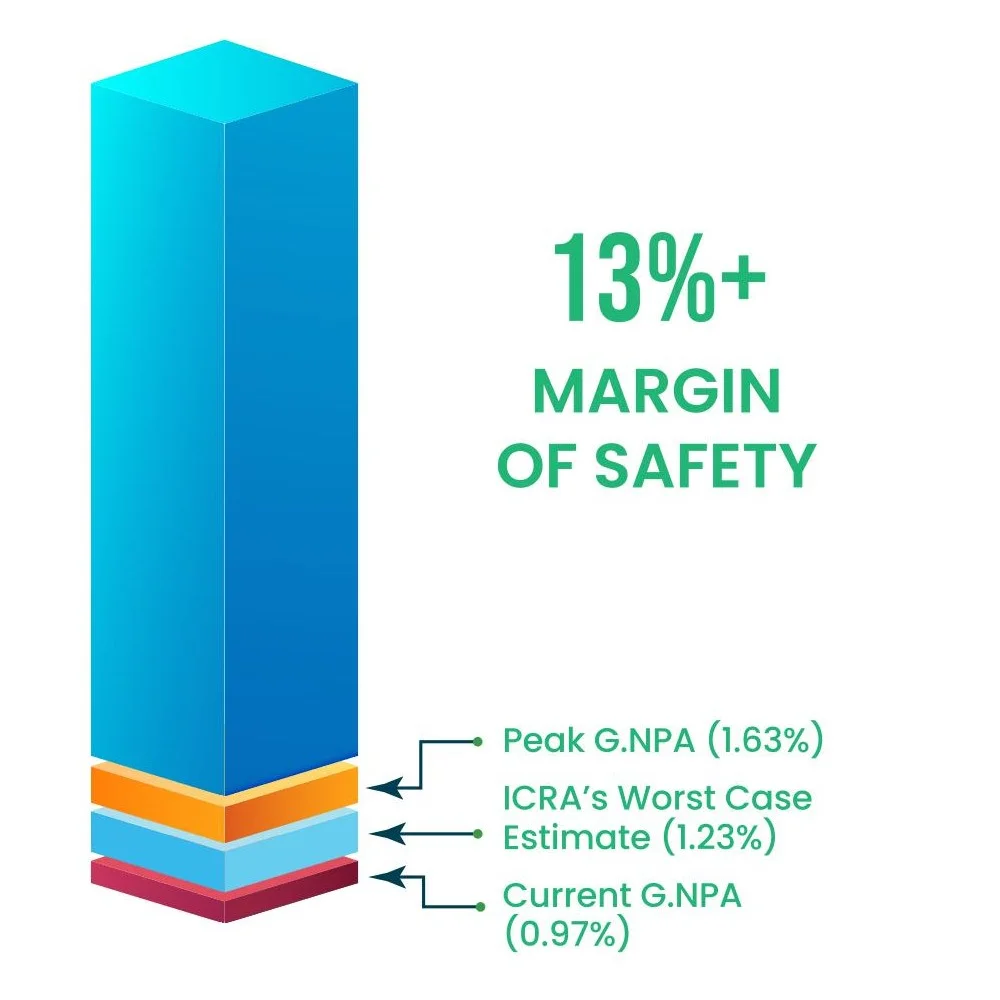

- Lenders have approx. 13%+ Safety Margin i.e. unless the NPAs increase by approx. 13% the lender shall continue to earn back their full capital & indicated return

- Currently, the Gross NPA for lenders on the platform, which is considerably lower than what ICRA, one of the most trusted rating agencies estimated 1.23% i.e. nearly 10x lower than available afety margin

- Since inception, 100% of lenders have made full return with LiquiLoans

High Diversification:

- Lending is spread/diversified across Avg. 200-300+ borrowers making exposure to a single

borrower less than avg. 0.5%. High diversification reduces concentration risk.

Escrow-trustee fund flow structure

Platform earns only after the Lender

- LiquiLoans only charges a success-based fee with no expense ratio/management fee i.e. part of any incremental return earned over the lender’s indicated return will be expensed to LiquiLoans post lender’s indicated return payouts

- In the event the lender does not make returns more than the indicative yield, LiquiLoans fees will be zero

| SCHEMES (MHP IN MONTHS) | FRESH LENDING SCHEMES YIELDS (INDICATIVE XIRR) | BENEFITS |

| SPECIAL LOCK-IN SCHEMES | ||

| 5 MHP | 9.75% |

|

| 10 MHP | 10.00% |

|

| 20 MHP | 10.25% |

|

| 30 MHP | 10.50% |

|

| NIL MHP | 8.00% |

|

| ||

| 3 MHP | 8.60% |

|

| 6 MHP | 9.00% |

|

| 12 MHP | 9.25% | |

| 24 MHP | 10.00% |

|

| Simple Interest |

| |

| 36 MHP | 10.50% |

|

| Simple Interest | ||

| 12 MHP (D. ADV) | 9.00% |

|

| 24 MHP (D. ADV) | 9.10% |

|

| 36 MHP (D. ADV) | 9.25% |

|

| SIP (NIL MHP) | 8.00% |

|

| ||

| Lending Amount (Per PAN) |

| |

| ||

| Who can Lend |

| |

| Interest Payout Options |

| |

| ||

| Taxation |

| |

| ||